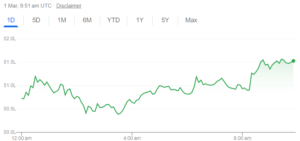

Bitcoin rose as much as 5.12% to $63,649 by 9:30 am (local time) in New York.

Cryptocurrency Bitcoin on Thursday surpassed $60,000 for the first time in more than two years.

The surge is fueled by growing optimism that the demand for the cryptocurrency is expanding beyond dedicated digital asset enthusiasts, as reported by Bloomberg.

On Thursday, the cryptocurrency experienced an increase of up to 5.12%, reaching $63,649 by 9:30 am (local time) in New York. Bitcoin had previously spiked to $63,968 on Wednesday but retraced its gains to close below $59,000.

The last time Bitcoin traded at the $60,000 level was in November 2021, following its record-high peak of nearly $69,000 earlier in the same month.

As reported by Bloomberg, Bitcoin has seen a surge of over 40% since the beginning of the year, driven by the successful launch of US Exchange-Traded Funds (ETFs) specifically holding the cryptocurrency.

The Reasons Behind the Rise in Bitcoin Prices

Chris Newhouse, a DeFi analyst at Cumberland Labs, suggests that Bitcoin is reaching new annual highs due to heightened demand in the spot market and momentum traders entering positions following a week of consolidation.

In addition to these factors, the optimistic sentiment in the cryptocurrency market is further fueled by the anticipated decrease in Bitcoin’s supply growth.

Jonathon Miller, managing director of the Kraken Australia digital-asset exchange, highlighted the convergence of several factors propelling Bitcoin optimism. These include the influx of funds into the US spot Bitcoin ETF, the upcoming reduction in new Bitcoin issuance through the halving, and a renewed positive outlook on the entire cryptocurrency asset class.

Zaheer Ebtikar, founder of the crypto fund Split Capital, expressed the growing conviction among people to buy into Bitcoin, describing the current market movement as a pronounced “Fear of Missing Out” (FOMO) rally.

However, some experts have cautioned about the possibility of a significant correction in the ongoing rally.

Jaime Baeza, founder of the crypto hedge fund AnB Investments, has cautioned about the rapid and substantial nature of the recent move in Bitcoin prices. He pointed out that the current market exhibits high leverage, as indicated by derivatives basis and funding rates. Baeza stated that he wouldn’t be surprised by a significant correction, possibly around 20% or more. Despite this, he emphasized that he wouldn’t be actively shorting the market during this ongoing rapid rally.

Price Surge:

- Bitcoin continued its impressive rally, briefly surpassing $63,000 for the first time in years. This represented a significant jump from around $57,000 just a day earlier. [Source: Investopedia]

- The surge came amidst a broader decline in the traditional stock market, highlighting the potential for Bitcoin to act as an uncorrelated asset class. [Source: Investopedia]

Expert Opinions:

- The Independent featured a live coverage of the crypto market, highlighting growing excitement surrounding Bitcoin as it neared its all-time high. [Source: The Independent]

- JPMorgan, however, offered a cautionary note, predicting a potential price drop to $42,000 after the upcoming Bitcoin halving event due to reduced miner profitability. [Source: CoinDesk]

Technical Analysis:

- Chris Lewis, a technical analyst on YouTube, expressed concern about the rapid price rise and suggested a potential pullback before a sustainable upward trend could be established. [Source: YouTube]

Other Notable News:

- StarkWare, a blockchain scalability solution provider, unveiled a new cryptographic prover, “Stwo,” aimed at significantly improving transaction processing speed. [Source: CoinDesk]

- Coinbase introduced a “Smart Wallet” feature, eliminating the need for lengthy seed phrases for accessing crypto wallets. [Source: CoinDesk]

Overall Sentiment:

The overall sentiment surrounding Bitcoin on February 29th, 2024, was positive but cautious. The surge in price fueled excitement, but concerns about the halving event and potential for a correction existed alongside. This highlights the importance of conducting thorough research before making any investment decisions related to Bitcoin.

To read more interesting blogs Click here…